Fortrade Review

Program Details

FCA, ASIC, CySEC, NBRB, FSC, IIROC

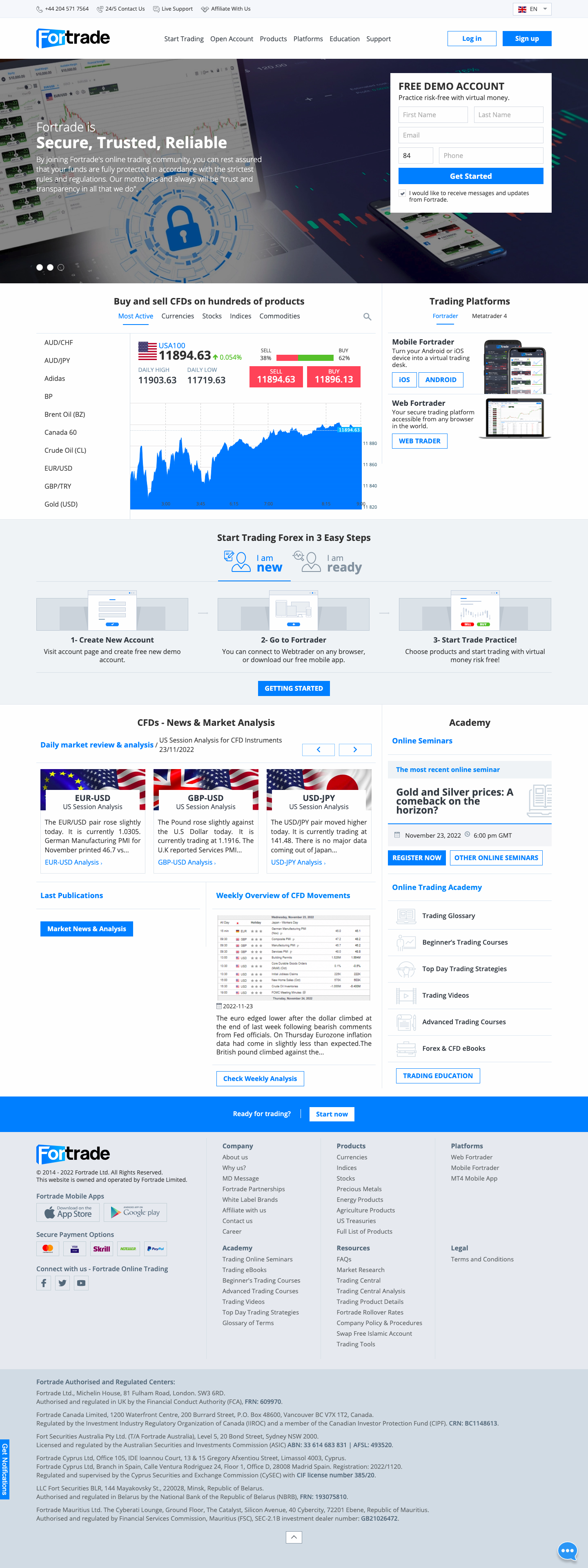

Fortrade is an international forex broker offering online CFD trading across multiple asset classes and two platforms. This review of the website looks at the regulatory oversight by jurisdiction, demo accounts, minimum deposits, the login process, and more. Find out if you should start trading with Fortrade.

Company Details

Fortrade Limited (Ltd) was established in 2013 in the United Kingdom. The broker’s core team is based in London and Watford in the UK and is headed up by CEO, Nick Collison. Today, the service operates on a global scale, with office locations and regulatory frameworks in Belarus, Australia, Canada, Cyprus and more. It is estimated that almost two million people have registered for a live account since the company launched.

Fortrade’s goal is to be a leading provider in the forex and CFD markets, offering top-class services, products and technologies alongside competitive fees. Fortrade provides trading opportunities in forex, commodities, indices, stocks, ETFs and more on the MetaTrader 4 platform as well as the proprietary ForTrader web terminal. The group offers clear and simple solutions for both new and experienced individual clients.

Trading Platforms

Fortrade offers two trading platform terminals; MetaTrader 4 (MT4) and a proprietary terminal named Fortrader.

MT4 can be downloaded to Mac or Windows devices and can be used as a webtrader. The broker’s bespoke software is available as a web-based platform only, accessible from any PC with an internet connection.

While using Fortrade’s platforms, we were comfortable that they are suitable for beginners, with customization features and adequate search functionality. Nonetheless, it is worth checking out the demo platforms before opening a live profile.

MetaTrader 4

Whether you are a novice or a seasoned trader, the MetaTrader 4 (MT4) platform is an award-winning favorite. The platform hosts a selection of features that provide a powerful trading experience to suit a variety of strategies.

Users benefit from 30 built-in technical indicators and 24 graphical tools such as Gann lines or Fibonacci curves. The nine timeframes allow you to track detailed price movements on one of three types of chart; line, candlestick, or bar.

Automated trading is also available through Expert Advisors (EAs) along with multiple order types and one-click trading. Users also benefit from access to full trading histories.

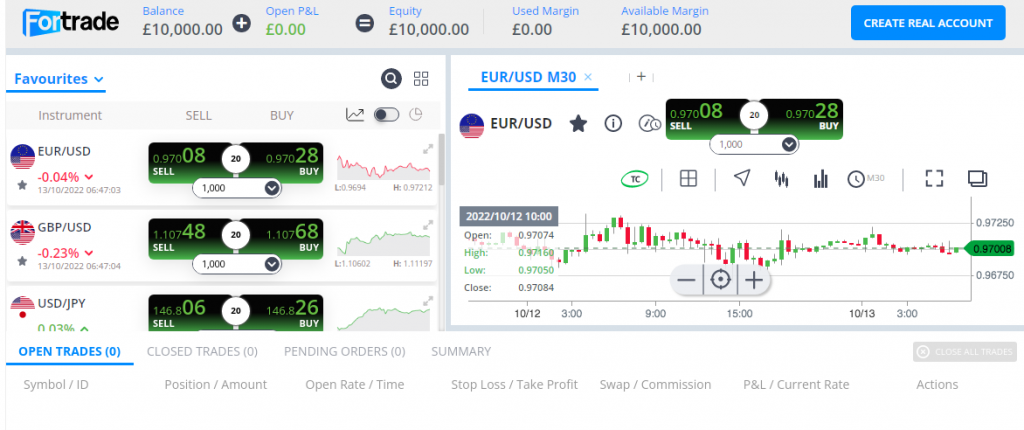

Fortrader

The Fortrader platform leverages the brand’s technological advancements within a bespoke software offering. The platform is a low-latency system, yet powerful at delivering real-time data with high speed and precision. The one-stop-shop allows investors to track, analyze, and trade using a cross-device platform which saves time and hassle.

Our experts confirm the terminal offered simple navigation and a more sleek and modern design vs MT4. You can spend some time within a demo profile to get comfortable with all the features before committing to a live account.

How To Place A Trade

- Choose your trading platform

- Find the asset you want to trade via the search bar or drop down list

- Select new order or execute a trade directly via charts

- In the new order screen, enter the relevant details including asset symbol, volume to trade and order type

- Check all details are correct. Select buy or sell

- Confirm the order

Assets & Markets

Traders can access a wide range of markets at Fortrade:

- ETFs – Trade long or short on Exchange Traded Funds

- Bonds – Trade on 5-year, 10-year, or 30-year US Treasury notes and bonds

- Indices – Trade on 18 of the world’s leading stock indices such as the FTSE 100 and DAX 40

- Direct Market Access Stocks – Speculate on the price of DuPont de Nemours among other equities

- Currencies – Trade 50+ major and minor currency pairs including GBP/USD, USD/EUR and USD/JPY

- Cryptocurrencies – Speculate on the price of four digital currency coins including Bitcoin, Dash and Ethereum

- Commodities – Trade on energies, precious metals and agricultural products including crude oil, gold and sugar

- Stocks – Buy and sell equity CFDs on 100+ of the largest global companies including Disney, Unilever and AirBnb

Spreads & Commission

When using Fortrade, you will not incur any trading commissions. Instead, the broker charges a small mark-up on the market spread price. Spreads are floating and therefore may fluctuate during times of high liquidity. We were offered average spreads of 2 pips for the USD/GBP forex pair and 3 pips for the EUR/GBP currency pair. The S&P 500 index was offered at 0.6 points. These spreads are not low vs competitors such as eToro or Plus500.

Other fees include overnight rollover charges as well as an inactivity fee of 10 (GBP/EUR/USD) on accounts left dormant for six months.

Fortrade Leverage

Fortrade offers leveraged trading, though maximum ratios comply with the regulatory restrictions in each jurisdiction. For example, investors registered under Fortrade Ltd and Fortrade Cyprus Ltd will be able to access maximum leverage of 1:30 on major currency pairs under the ESMA margin cap, introduced in 2018.

Margin requirements can be found on the Trading Conditions page.

Mobile Apps

Both MT4 and the Fortrader platform are available as convenient mobile apps. These can be downloaded for free to iOS and Android (APK) devices. When we used the MetaTrader 4 application, we were able to fully manage our trading account and place trades from anywhere. You can find the same features as the desktop version, including easy scrolling, push notifications, one-touch trading, and more.

The Fortrader platform is also available as a mobile app, suitable for iOS and Android smart devices. When using the mobile application, it was clear it offered full-scale functionality and user-friendly navigation. Having said that, the app is rated just 2.7/5 on the Apple App Store and Google Play Store, with many reviews indicating slow server times and inefficient deposit processing times.

Payment Methods

Deposits

Our experts found Fortrade offers some good funding options, including credit and debit cards, bank transfers, and e-wallet solutions such as Neteller and Skrill. The recommended initial deposit requirement is 500 (GBP/USD/EUR), however, it is possible to deposit as little as $100 or equivalent currency to get started.

It is a shame to see when depositing to your Fortrade account that proof of payment has to be emailed to the broker for funds to be activated in your live profile. Nonetheless, the broker does not charge any deposit fees.

Processing times will vary by method. Bank wire transfers can take up to seven working days for funds to clear. E-wallet solutions offer faster clearance, often within one day.

Withdrawals

The same payment methods apply for withdrawals. All requests are processed by Fortrade within two business days of being submitted. However, fund clearance can take up to five business days for bank transfers and up to 15 business days for credit/debit cards. These aren’t the quickest timescales compared to other brokers.

It is worth noting, any bank withdrawal fees incurred by Fortrade are passed on to the customer, which is usually around $40.

Fortrade Demo Account

A free demo account is available to Fortrade customers. Our experts signed up within just one minute. Users can practice their trading strategy with a €10,000 virtual investment, available on either the Fortrader or MetaTrader 4 platforms.

Paper trading profiles are a great way to practice trading completely risk-free and learn all the features and functionality available in a live profile.

When we used the Fortrade demo account, we were pleased to see no time restrictions. This makes it a great training tool for beginners who wish to practice within a real environment, with no pressure.

Deals & Promotions

Fortrade is a fully regulated broker and therefore does not offer no deposit bonus deals or promotions.

Regulation & Licensing

Fortrade operates several via trading entities, with differing regulatory oversight and consumer protection:

- Fortrade Ltd – regulated by the UK Financial Conduct Authority (FCA), FRN 609970

- Fortrade Cyprus Ltd – regulated and supervised by the Cyprus Securities and Exchange Commission (CySEC), CIF 385/20

- Fort Securities Australia Pty Ltd – licensed and regulated by the Australian Securities and Investments Commission (ASIC), AFSL 493520

- LL Fort Securities BLR – authorized and regulated in Belarus by the National Bank of the Republic of Belarus (NBRB), FRN 193075810

- Fortrade Mauritius Ltd – authorized and regulated by Financial Services Commission, Mauritius (FSC), investment dealer number GB21026472

- Fortrade Canada Limited – regulated by the Investment Industry Regulatory Organization of Canada (IIROC), CRN BC1148613. The broker is also a member of the Canadian Investor Protection Fund (CIPF)

It is good to see that Fortrade offers negative balance protection across all entities. Additionally, Fortrade.com segregates its client funds at trusted financial institutions.

Depending on your trading entity, you may have access to consumer protection schemes. For example, Fortrade Ltd is covered by the Financial Services Compensation Scheme (FSCS), meaning £85,000 compensation per person is available in the event of liquidation.

Overall, when we used Fortrade, we are satisfied it is a legitimate broker and not a scam.

Note, Fortrade does not accepts USA residents.

Additional Features

We were impressed with Fortrade’s comprehensive selection of educational resources and tools suitable for all levels. Information is categorized by experience so you can access suitable content. The Academy contains several online seminars, eBooks, training courses, tutorial videos, tips, and more.

Traders can also access a wide range of resources and market research from the Market Analysis center, with morning, evening, and weekly news analysis, as well as Trading Central, a package of technical analysis tools.

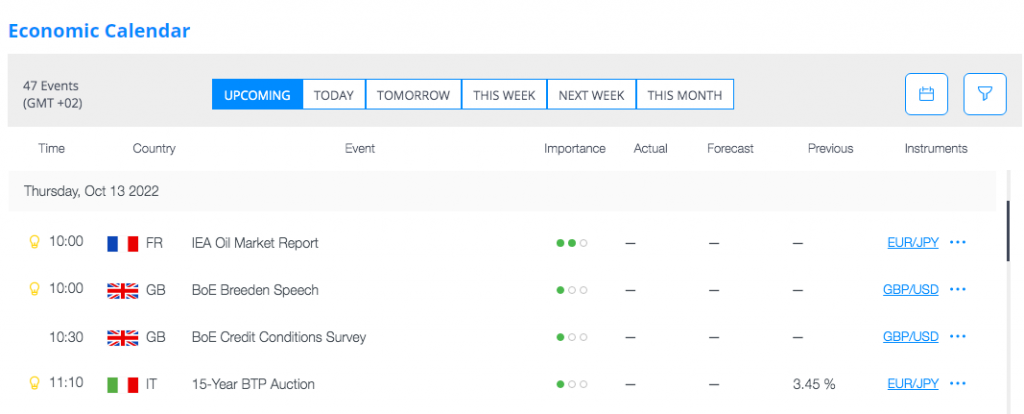

Other practical features include a currency converter tool, calculators, and a useful economic calendar.

Live Account

Fortrade operates a single account, where specific trading conditions vary depending on the asset and trade size. The minimum recommended deposit is 500 (GBP/EUR/USD), though you can deposit as little as $100 or equivalent.

To open an account, head to the ‘Sign Up’ button on the website to fill in your personal registration details and verify your identity. You can then manage your account from within the client portal and switch between a live and practice profile.

Islamic swap-free accounts are also available and can be requested by email.

Benefits

Advantages of trading with Fortrade include:

- Choice of platforms

- Online CFD trading APK

- Unlimited time demo account

- Wide range of markets available

- Comprehensive educational resources and content

- Multi-entity regulation including FCA, CySEC and ASIC

Drawbacks

Fortrade’s ratings fall down in the following areas:

- Wide spreads

- Slow withdrawals

- Only one account type available

Fortrade Trading Hours

Trading hours will vary by instrument. The broker operates on a GMT server time with trading commencing at 22:00 GMT in the summer or 21:00 GMT in the winter to account for daylight saving hours.

Forex pairs can be traded 24 hours per day, 5 days a week. The cryptocurrency market, on the other hand, does not close on weekends.

Keep an eye on the published market hours for updates and upcoming changes to typical trading sessions.

Customer Support

You can contact the multilingual support team at Fortrade via:

- E-mail – support@fortrade.com

- Online enquiry form – accessed via the support page

- Live chat – chat logo located at the top of the home page

- Telephone – +357 25 262083. Local phone numbers are also available

Live chat support is the most convenient. When we used Fortrade, we received a response within three minutes. Staff were able to help with a range of queries, from withdrawal problems and apps not working to how to close or delete an account. Alternatively, an FAQ section is available for self-service assistance.

Fortrade’s head office is located at Michelin House, 81 Fulham Road, London, SW3 6RD, United Kingdom. See the broker’s website for the postal address of their Belgrade, Istanbul, Albania, Kosovo or other offices.

Client Security

Both the Fortrader.com and MetaTrader 4 platforms are safe to use and protected by Secure Sockets Layer (SSL) encryption. You can also enable two-factor authentication (2FA) at the login stage. All client transactions are also carried out via an SSL-encrypted connection and servers are located in high-quality SSAE 16/SAS 70 Type I and Type II locations.

Retail traders can rest assured that funds are fully protected in accordance with the strictest rules and regulations. The broker’s motto has captured this; “trust and transparency in all that we do”.

Fortrade Verdict

Fortrade offers online trading across a wide variety of asset classes through one account. Trading conditions are decent, though the broker does not offer the lowest spreads in the industry and the deposit authorization process seems archaic. However, Fortrade does offer a good selection of educational resources and daily market analysis, making it a goof option for beginners.

Accepted Countries

Fortrade accepts traders from Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use Fortrade from United States.

Be the first to review “Fortrade Review”

You must be logged in to post a review.

Reviews

There are no reviews yet.